The Centers for Medicare and Medicaid Services (CMS) updates its reimbursement rules and rates for medical services each year. This article will discuss and compare the most relevant changes in its 2021 and 2022 updates and their potential impact on workers compensation (WC) medical costs.

Introduction

The National Council on Compensation Insurance (NCCI) monitors changes in CMS reimbursement rules and rates that may impact WC medical costs. In the published article titled,

2021 CMS Fee Schedules and Workers Compensation, NCCI highlighted some of the most impactful changes that took place in the 2021 update. The Producer Price Index for health care services already reflected those 2021 changes to CMS physician reimbursement rates in reported medical price inflation. The Producer Price Index for health care services increased by 3% in 2021, significantly influenced by physician services, which grew 4.5%.1 The 2021 NCCI article also provided an overview of how WC fee schedules operate, providing a source of information regarding Relative Value Units (RVUs) and CMS’ formula for calculating payment rates.

This 2022 article focuses on comparing the 2021 and 2022 CMS updates to reimbursement rules and rates and provides insight on some early effects of the 2021 changes on WC medical costs based on data reported to NCCI through its Medical Data Call (MDC) for the first three quarters of 2021. This article discusses CMS fee schedule changes for three categories of medical services:

- Physician

- Facilities

- Durable Medical Equipment, Prosthetics, Orthotics, and Supplies

Physician Fee Schedule Changes

Payment Rates

Payments for Evaluation and Management (E/M) services such as office visits represent about 22% of countrywide2 WC physician costs. The 2021 CMS Physician Fee schedule (PFS) implemented significant increases to the RVUs for E/M services. Therefore, depending on the individual state fee schedule’s reliance on CMS’ published values, the 2021 update may have resulted in increases to the maximum allowable reimbursements and consequently to WC medical costs. In aggregate, the 2021 E/M RVUs increased by 13%. In comparison, the 2022 E/M RVUs decreased by less than 1%.

To illustrate the comparison between the 2021 and 2022 updates, the table below shows historical RVUs for the most common E/M services. These services account for more than 75% of WC countrywide E/M transactions.

The effects of the 2021 CMS physician fee schedule changes on E/M services are already observable in emerged WC experience. The graph below shows the change in paid per transaction for Common Procedural Terminology (CPT) Code 99213 indexed to 2016 for the collection of states with and without CMS-based fee schedules. The two groups of states track each other through 2020. However, once the increased CMS RVUs began to be incorporated in 2021, the changes in paid per transaction diverge, as the result for states with CMS-based fee schedules notably increased.

The conversion factor is another component integral to the determination of reimbursement rates. While RVUs vary by specific medical service, the conversion factor is constant across physician service categories other than anesthesia and serves to convert the RVU into a dollar maximum allowable rate.

The table below shows CMS’ published conversion factor for physician services for the last three calendar years.

The impact on WC medical costs due to changes in E/M RVUs, as well as conversion factors, will vary by state. The decrease in the conversion factor mitigates the expected 2021 increase to the costs of E/M services. As the conversion factor does not vary by type of physician service, other service categories can expect decreases or mild increases in costs, since their RVUs did not increase as significantly in 2021. As shown in the table above, the 2022 CMS PFS update modestly decreased the conversion factor by 0.8%.

Radiology services, which account for approximately 8% of WC physician costs, are likely to experience larger cost decreases in 2022 relative to other physician services, as radiology RVUs for costlier services (e.g., MRIs and CAT scans) are decreasing measurably. The table below shows the change in RVU for CPT Codes 73221 and 73721, which account for more than 25% of countrywide WC radiology payments.

The impacts discussed above will vary by the extent to which each individual state bases its medical fee schedule on CMS-published values. Additionally, the cost impact for states that rely on CMS to establish their fee schedules will depend on the date on which the states adopt the new values. Many states incorporate the updated CMS values at the time they become effective, but there are some states that lag (a few as far as the following year). The map below highlights the status of implementing CMS PFS for states that have CMS-based physician fee schedules.

States yet to incorporate changes from the 2021 final rule may expect to see increases in physician costs due to the 2021 E/M RVU change while states which have already incorporated the 2021 final rule may expect to see modest changes to physician costs attributable to the 2022 final rule.

Telemedicine

As a result of the COVID-19 Public Health Emergency, patients became more amenable to receiving remote treatment. Due to unprecedented telemedicine growth in 2020, CMS expanded its list of telehealth services in 2021 and created a family of seven codes labelled as Remote Physiological Monitoring (RPM) services. In its 2022 final rule, CMS announced the creation of a new family of codes called Remote Therapeutic Monitoring (RTM) services. These services allow the remote treatment of patients outside the traditional clinical environment. Unlike RPM services (E/M codes for which the patient meets virtually with the provider and provides physiological data), RTM services are classified as general medicine services geared towards respiratory and musculoskeletal conditions, and do not require the sharing of physiological data.

As the expansion of telemedicine and the establishment of the RPM and RTM code families are recent developments, the direct cost impact of these changes cannot be reasonably quantified at this time.

Facility Fee Schedule Changes

Payment Rates

Facility costs account for approximately 40% of WC medical expenditures and have been a significant WC cost driver in recent years. Similar to the process of establishing payment rates for physician services, CMS also calculates payment rates for facility services. CMS’ Hospital Inpatient, Hospital Outpatient, and Ambulatory Surgical Center payment systems are assigned a constant base rate to apply to each individual service. The facility base rates are standardized across services and can be useful in suggesting the direction of cost impacts. The base rates vary by individual hospital, but CMS publishes the national values. The table below shows the changes in national base rates for the 2022 update.

The increases in base rates are consistent with increases in recent years, and will potentially result in comparable increases in facility costs for the WC system.

Reinstatement of the Hospital Inpatient Only List

The final CMS 2021 rule introduced a rolling plan to eliminate the Hospital Inpatient Only List. This list consists of a set of procedures that are only reimbursable under CMS in a hospital inpatient setting. The elimination schedule consisted of a three-year transitional period to remove codes from the list, allowing their reimbursement in a hospital outpatient or ambulatory surgical center setting. During the first phase, CMS removed 298 codes (primarily musculoskeletal-related) from the list. The 2022 final rule halted the transition and added back the services removed in 2021, except for three CPT codes along with their corresponding anesthesia codes. The CPT codes to remain compensable in a hospital outpatient or ambulatory surgical center setting are:

- 22630 (lumbar spine fusion)

- 23472 (reconstruct shoulder joint)

- 27702 (reconstruct ankle joint)

Their corresponding anesthesia codes remain compensable as well.4

COVID-19 and Data

CMS utilized data from Calendar Year (CY) 2019 instead of 2020 to set the rates for its 2022 facility fee schedules. The rationale for this decision was that, due to the COVID-19 Public Health Emergency, “The CY 2020 data are not the best overall approximation of expected outpatient hospital services in CY 2022.”4

The United States Bureau of Labor Statistics’ publication of the percentage changes for employment costs indicates a large increase in wages for hospitals and nurses in 2021. The increase for the industries relevant to medical care for the 12 months ending December 2021 ranges from +4% to +6%.5 As CMS did not utilize 2020 experience in the calculation of fee schedule factors for 2022, the increase in wages for 2021 may be reflected in the CMS fee schedule factors for 2023, if it utilizes CY 2021 data.

Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS)

The DMEPOS fee schedule for January 2022 increased the reimbursement for certain services by a significantly higher amount than observed in recent years. CMS adjusts the DMEPOS fee schedule each year depending on the grouping of services into two categories. The first grouping is for codes subject to the DMEPOS Competitive Bidding Program. The second grouping is for codes not subject to the Competitive Bidding Program. A CMS-calculated factor, composed of the Consumer Price Index for All Urban Consumers (CPI-U) and a productivity adjustment, updates the reimbursable amount for the latter group.

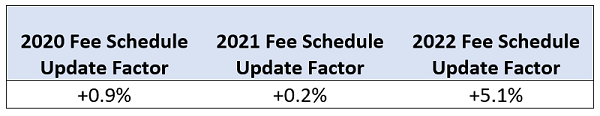

The table below shows the CMS-published fee schedule update factors for DMEPOS services for the three most recent calendar years:

The CPI-U from June 2020 to June 2021 of 5.4%, reduced by a 0.3% productivity adjustment, determined the 2022 update factor of 5.1%. The share of medical costs for DMEPOS services varies between states but is, on average, between 5% and 11% of overall WC medical costs.

Concluding Remarks

Following the 2021 CMS revisions to the PFS—particularly the large changes to the RVUs for E/M services—the 2022 CMS revisions were relatively minor. Each individual state will have varying impacts on medical costs depending on its unique reimbursement rules.

The 2022 adjustments to facility fee schedules are consistent with the recent prior-year updates, reflecting general reimbursement increases for services in a facility setting. CMS also reversed its decision to eliminate the Inpatient Only List in 2022.

The use of 2019 data to determine 2022 facility reimbursement adjustments may result in larger, upward increases in facility fee schedule rates in 2023 and beyond, as more recent data reflective of wage increases will be utilized.

NCCI will continue to monitor these and other pertinent changes in CMS reimbursement rules, as well as how they may impact WC medical cost trends.

This article is provided solely as a reference tool to be used for informational purposes only. The information in this article shall not be construed or interpreted as providing legal or any other advice. Use of this article for any purpose other than as set forth herein is strictly prohibited.